31+ how to calculate excess return

Since the size and the length of. Normally the market return of a given day is calculated from the previous days close not from that days open so the return on day 2 is 57072 56251 821 or.

How To Get The Average Monthly Percent Excess Returns For Portfolios Formed Researchgate

Web In this module you will learn how to calculate different return and risk measures and how you use these measures to evaluate a portfolios performance.

. I divided the rate by 100 because it. Web first I calculated the returns with ln priceprice on previous week then I did this with the 3M T-bill rate. Web Mathematically speaking excess return is the rate of return that exceeds what was expected or predicted by models like the capital asset pricing model CAPM.

Web We take the excess returns and divide them by our cost of equity we just calculated. Present value of excess returns 359233 109 329566. Web Up to 25 cash back The yearly compounded interest rate is given by 1 y 12 1.

How to Calculate Expected Rate of Return. Web Up to 25 cash back Excess returns. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need.

The annual rate is used to estimate a yearly return and is very useful for forecasting. Web An asset is expected to generate at least the risk-free rate of return. Web But if you have monthly data I would calculate the monthly ratio based on the average and std dev of all the monthly data not the average monthly return for each.

Web The formula to calculate is. An example calculation of. If you want to compute the monthly excess return for month i expressed on an annual basis you could simply use 1 r i p 12 1 r i b 12 where.

Each day we record your portfolio value the change from the. Web Average return used in Sharpe Ratio and found in your performance page is your average daily returns. To determine the rate of excess returns youll use a formula called the Capital Assets Pricing Model.

Excess return Total return Expected return T r Risk-free rate BetaMarket risk premium T r R f βR m R f Excess Return. Ln rate100 1 52. Web Jul 19 2013 at 1115.

Web In finance a return is a profit on an investment measured either in absolute terms or as a percentage of the amount invested. Web For exchange-traded funds ETFs the excess return should be equal to the risk-adjusted or beta measure that exceeds the instruments benchmark or annual. Web In order to calculate excess returns subtract the returns on a risk-free investment from the returns on an investment and that will equal the excess returns.

Web returns excess_returns date ticker 2020-01-01 SPY 1 0 AAPL 2 1 MSFT 3 2 2020-02-01 SPY 4 0 AAPL 5 1 MSFT 6 2 2020-03-01 SPY 7 0 AAPL 8 1 MSFT 9 2. In order to perform a robust analysis on your portfolio returns you must first subtract the risk-free rate of return from your portfolio returns. It can be calculated under the.

Web Mary notices the Big Blue Mutual Fund had a return of 12 last year. The riskless rate on T-Bills was only 3 so to calculate the excess returns enjoyed by investors in Big Blue. Web Excess return also known as alpha is a measure of how much a fund has under or outperformed the benchmark against which it is compared.

If the Beta of an individual stock or portfolio equals 1 then the return of the asset equals the. Web For example if you want to calculate the annualized return of an investment over a period of five years you would use 5 for the N value. Web Personal Finance.

Calculate The Sharpe Ratio With Excel

Hp 12c Platinum Solutions Handbook

Final Directtaxlaw Practice Pdf Income Tax Tax Deduction

Excess Return Overview How To Compute Example

Hutto Isd Benefit Guide 2021 2022 Flipbook By Combined Benefits Group Fliphtml5

Pd Liod Iccf

:max_bytes(150000):strip_icc()/GettyImages-160519027-9bc7b5b9500346eda384937f12423c93.jpg)

Excess Returns Meaning Risk And Formulas

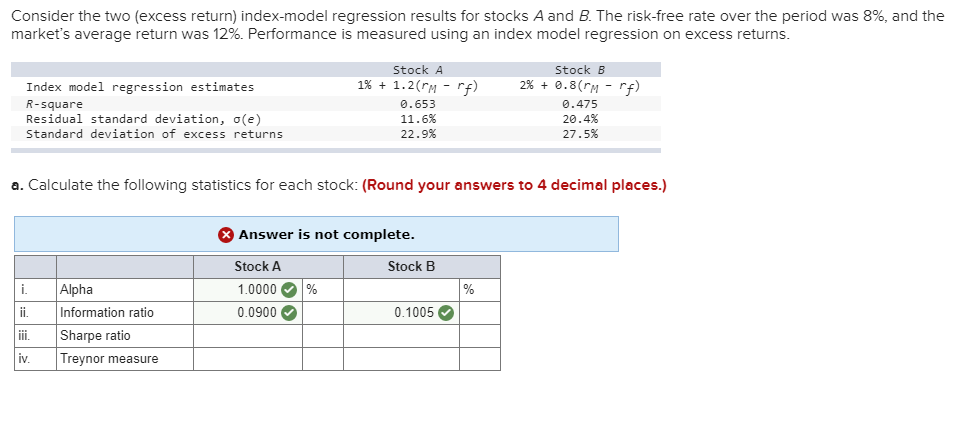

Consider The Two Excess Return Index Model Chegg Com

Thermodynamics Pdf

Excess Return Overview Formula Excess Return Calculation Study Com

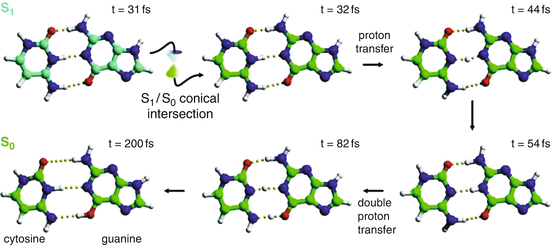

Ab Initio Investigation Of Photochemical Reaction Mechanisms From Isolated Molecules To Complex Environments Springerlink

How To Calculate Excess Returns Sapling

Icpe All Access Conference Abstracts 2020 Pharmacoepidemiology And Drug Safety Wiley Online Library

Solved 9 Consider The Two Excess Return Index Model Chegg Com

Excess Return Eva Data Guide To Spreadsheet Youtube

Lbcer8kex992 2020q4

What Are Average Excess Returns Equitysim